FHA 203(k) Rental Investment Strategy for SFR's & Multi-Family Homes

Unlocking Wealth Through Strategic Real Estate Investments

2025 Tips for New Home Buyers!

The 2025 housing market presents a dynamic mix of challenges and opportunities for homebuyers and investors.

With fluctuating interest rates, shifting inventory, and economic uncertainties, strategic planning is essential to maximize returns.

This article explores four powerful strategies for 2025 homebuyers: leveraging the FHA 203(k) loan for rental investments, using FHA loans to invest in multi-family residences, avoiding the trap of market timing, and increasing property value through cosmetic upgrades.

Disclaimers!: The Real Estate HUB is an Amazon & Sovrn Commerce affiliate. Some links in this article will take you to products and we may earn a commision at no extra cost to you. Furthermore, The Real Estate HUB and its affiliates are not Licensed Financial Advisors or Consultants, nor are lawyers or attorneys at law. The Real Estate HUB is also not a licensed broker. Please DYOR and speak to LICENSED Local professionals.

We claim no responsibility for any financial or legal decisions you make.

https://medium.com/@TheRealEstateHUB/subscribe

Whether you’re a first-time buyer or a seasoned investor, these tips will empower you to navigate the market confidently and build long-term wealth.

FHA 203(k) Rental Investment Strategy

This government-backed mortgage combines the purchase price and renovation costs into one loan, making it ideal for transforming fixer-uppers into profitable rental units.

Turning Multi-Family Fixer-Uppers into Cash Flow! 🤑

The FHA 203(k) loan is a game-changer for buyers looking to purchase and renovate distressed properties, especially for rental investments.

In 2025, with undervalued properties still available in many markets, the 203(k) strategy offers a clear path to wealth-building.

How It Works

The FHA 203(k) loan is a powerful tool for 2025 homebuyers and rental investors, enabling them to purchase and renovate distressed properties with a single mortgage and a low 3.5% down payment.

Available in two forms — Standard 203(k) for major structural repairs and Limited 203(k) for cosmetic upgrades (up to $35,000) — the loan covers a wide range of improvements, from roofing and plumbing to kitchen remodels and flooring.

By targeting fixer-uppers in high-demand rental markets like urban centers, college towns, or job-rich suburbs, investors can transform undervalued properties into modern, high-rent units, generating cash flow and building equity.

The FHA’s requirement to occupy the property for 12 months can be met through house-hacking, such as living in one unit of a multi-family property while renting out the others.

The Standard 203(k) is ideal for properties needing significant work, like foundation repairs or room additions, with no upper limit on renovation costs (within FHA loan limits).

Learn How to Invest in Real Estate the Professional and low cost way!

It requires a HUD-approved consultant to oversee the project, ensuring compliance with FHA standards, and renovations must be completed within six months.

The Limited 203(k), conversely, is simpler, focusing on aesthetic upgrades like new countertops or energy-efficient windows, with no consultant needed.

Both options allow investors to enhance a property’s appeal to tenants, commanding premium rents in markets with rising demand (e.g., 3–5% rent growth projected for 2025 in cities like Austin and Raleigh).

Key upgrades, such as modern kitchens or smart home features, align with renter preferences, boosting rental income and property value.

For success, investors should research high-demand markets using tools like Rentometer, work with 203(k)-experienced lenders and contractors, and budget for contingencies (10–20% of renovation costs).

Combining the 203(k) with a multi-family property amplifies returns, as rental income from multiple units offsets mortgage costs.

Despite challenges like complex paperwork or potential renovation delays, strategic planning — choosing the right property, prioritizing high-ROI upgrades, and leveraging local market trends — makes the FHA 203(k) a low-risk, high-reward strategy for 2025, turning fixer-uppers into profitable rental assets.

Why It’s a Smart Move in 2025

- Low Down Payment: With just 3.5% down, the 203(k) is accessible for first-time investors or those with limited cash.

- Strong Rental Demand: Rent prices are projected to rise 3–5% in 2025 in markets like Austin, Phoenix, and Tampa, per recent trends, making renovated properties highly lucrative.

- Instant Equity: Buying a fixer-upper below market value and renovating it boosts equity, which can be leveraged for future investments.

Step-by-Step Strategy

- Target Rental Hotspots: Use platforms like Zillow or Rentometer to find areas with low vacancy rates and strong tenant demand.

- Identify Fixer-Uppers: Work with a 203(k)-savvy real estate agent to locate properties with renovation potential but solid foundations.

- Engage a 203(k) Consultant: For Standard 203(k) loans, a HUD-approved consultant ensures renovations meet FHA standards.

- Prioritize High-ROI Upgrades: Focus on renter-friendly features like modern kitchens, updated bathrooms, and energy-efficient appliances to justify higher rents.

- Secure Financing: Partner with a 203(k)-experienced lender, as the process requires detailed contractor bids and documentation.

- Renovate and Rent: Complete renovations within the FHA’s six-month timeline, then list the property to start generating income.

Multi-Family Residence FHA Investment Strategy:

For homebuyers seeking both a home and an investment, the FHA multi-family residence strategy is a standout option in 2025. FHA loans allow buyers to purchase multi-family properties (2–4 units) with the same low 3.5% down payment as single-family homes, enabling a strategy known as “house-hacking.”

House-Hacking for Wealth

By living in one unit and renting out the others, you can offset your mortgage, build equity, and gain real estate investing experience — all with minimal upfront capital.

https://medium.com/@TheRealEstateHUB/subscribe

How It Works: Why the FHA 203(k) Loan is a Smart Move for Michigan Investors and Homebuyers in 2025 🤯

FHA loans for multi-family properties (duplexes, triplexes, or fourplexes) follow similar guidelines to single-family FHA loans but allow you to generate rental income from additional units.

In 2025, the FHA 203(k) loan stands out as a strategic tool for Michigan investors and first-time homebuyers, offering a low 3.5% down payment that makes real estate investment accessible, even for those with limited cash.

This affordability is critical in Michigan’s diverse markets, where median home prices range from $150,000 in Flint to $300,000 in Ann Arbor, per Michigan Realtors.

Protect your home with

ANSQUE Security Cameras Wireless Outdoor Home System, 4 Camera Kit, No Subscription Fees, Solar Powered, Local Storage, 365-Day Battery Life

ANSQUE Security Cameras Wireless Outdoor Home System, 4 Camera Kit, No Subscription Fees, Solar Powered, Local Storage, 365-Day Battery Life

The loan’s ability to finance both the purchase and renovation of fixer-uppers allows buyers to target undervalued properties and transform them into high-value assets.

By focusing on high-demand rental markets like Detroit, Grand Rapids, or East Lansing, where CoStar projects 3–4% rent growth in 2025, investors can capitalize on strong tenant demand, making renovated properties highly lucrative.

Additionally, purchasing below market value and renovating creates instant equity — often $20,000–$50,000 on a $200,000 property, per local trends — which can be leveraged for future investments, amplifying wealth-building potential.

Step-by-Step Strategy for Success

To maximize the FHA 203(k) loan’s benefits, Michigan buyers should start by targeting rental hotspots using platforms like Zillow or Rentometer to identify areas with low vacancy rates (e.g., 5–7% in Ann Arbor) and strong tenant demand.

Working with a 203(k)-savvy real estate agent, they can locate fixer-uppers with solid foundations but renovation potential, such as older homes in Detroit’s revitalizing neighborhoods or multi-family properties in Lansing.

For Standard 203(k) loans, engaging a HUD-approved consultant ensures renovations — such as foundation repairs or roofing — meet FHA standards, while Limited 203(k) loans simplify cosmetic upgrades like flooring or kitchen refreshes.

Partnering with an experienced lender is crucial to navigate the detailed documentation and contractor bids required for financing.

Prioritizing High-ROI Upgrades

Focusing on renter-friendly upgrades is key to justifying higher rents and boosting property value.

In Michigan, modern kitchens with quartz countertops and energy-efficient appliances, updated bathrooms with new vanities, and durable luxury vinyl plank flooring align with tenant preferences, especially in college towns like East Lansing, per Redfin’s 2025 insights.

These upgrades, costing $5,000–$15,000, can increase rents by $100–$150 per unit, recouping costs in 4–6 years, according to the 2024 Remodeling Magazine’s Cost vs. Value Report.

Renovations must be completed within the FHA’s six-month timeline, so buyers should budget 10–20% contingencies for unexpected costs and hire licensed contractors to ensure quality and compliance.

Executing and Scaling in 2025

Once renovations are complete, listing the property on platforms like Zillow or Apartments.com attracts tenants quickly, generating income in markets with rising demand.

For example, a renovated duplex in Grand Rapids, purchased for $200,000 and upgraded for $30,000 via a 203(k) loan, could rent for $1,500 per unit, covering a $1,800 mortgage and yielding cash flow.

Michigan investors can amplify returns by house-hacking a multi-family property, living in one unit to meet FHA occupancy rules while renting others.

By combining these steps — targeting high-demand areas, securing expert financing, and prioritizing high-ROI upgrades — the FHA 203(k) loan empowers 2025 buyers to turn Michigan’s fixer-uppers into profitable rentals, laying a foundation for long-term wealth in a dynamic market.

You must occupy one unit as your primary residence for at least 12 months, but the rental income from other units can cover most — or all — of your mortgage payment.

After the occupancy period, you can move out, rent your unit, and purchase another property, scaling your portfolio.

Don’t Time the Market

Don’t Time the Market: Why Waiting Could Cost You

Attempting to time the real estate market by waiting for the perfect combination of low home prices and favorable interest rates is a common strategy, but it’s fraught with risks.

In 2025, with economic uncertainties like inflation, Federal Reserve policies, and geopolitical factors influencing the housing market, the urge to delay purchasing a home is understandable.

However, historical trends and current data suggest that waiting for ideal conditions often backfires, costing buyers opportunities for wealth-building and financial stability.

Instead of trying to predict unpredictable market shifts, homebuyers should prioritize their financial readiness and long-term goals to make informed decisions in 2025’s dynamic real estate landscape.

Why Timing the Market Fails: Unpredictability

The housing market is driven by a complex interplay of factors — interest rates, housing supply, consumer confidence, and macroeconomic trends — that are nearly impossible to forecast with precision.

For example, in 2023, many buyers postponed purchases expecting mortgage rates to drop significantly, only to face heightened competition in 2024 when rates stabilized but inventory remained tight.

The National Association of Realtors (NAR) reported that existing-home sales in March 2025 were at a seasonally adjusted annual rate of 4.02 million, down 5.9% from February, reflecting sluggish activity due to affordability challenges.

This unpredictability underscores why waiting for a “perfect” market moment often leads to missed opportunities, as conditions rarely align as expected.

Why Timing the Market Fails: Lost Equity

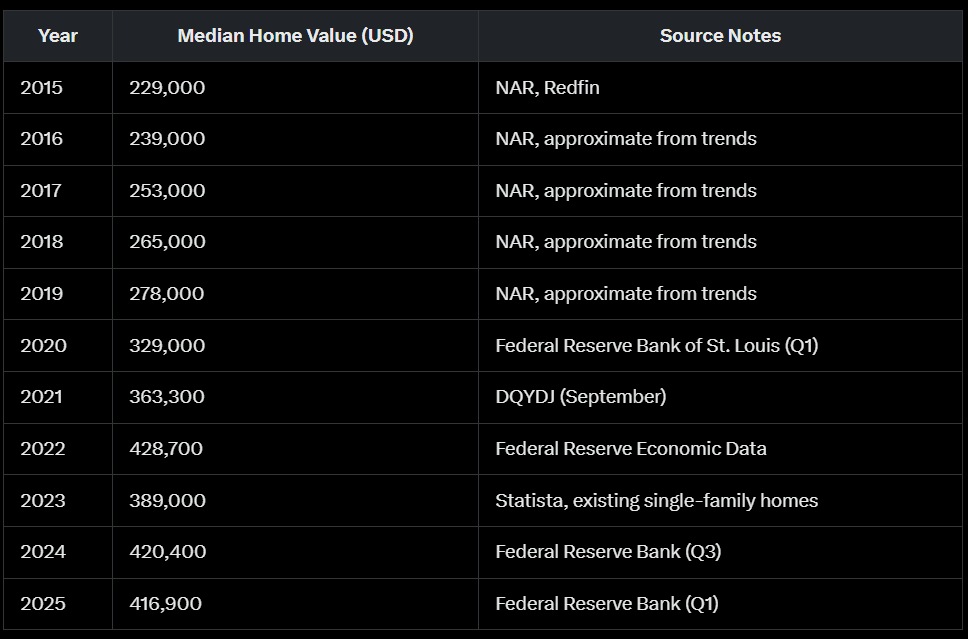

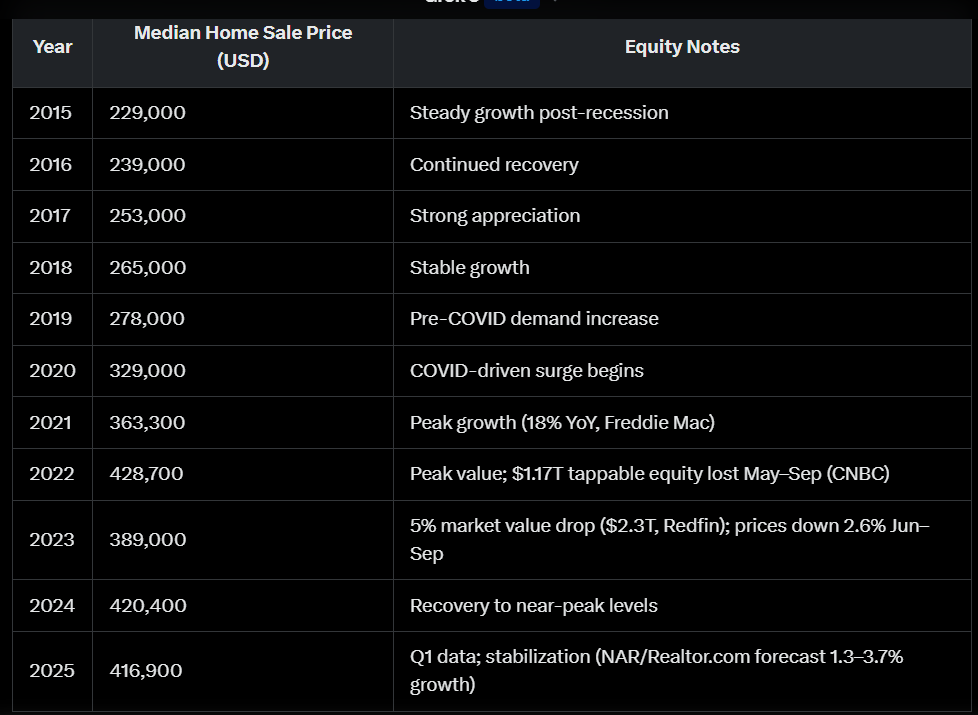

Delaying a home purchase means forgoing potential equity growth, which has historically been a cornerstone of real estate wealth-building.

According to the National Association of Realtors, home prices have appreciated at an average rate of 4–5% annually over the long term. In 2025, NAR forecasts a 2% increase in median home prices, while Realtor.com predicts a 3.7% rise, driven by persistent supply constraints.

Waiting a year could mean missing out on $8,000–$15,000 in equity on a $400,000 home, plus tax benefits like mortgage interest deductions. For buyers, this lost equity compounds over time, diminishing the financial advantages of early homeownership.

Why Timing the Market Fails: Rising Rents

For renters hoping to buy, waiting can exacerbate financial strain due to rising rental costs. In many U.S. cities, rents have increased by 3–7% annually, outpacing wage growth and making it harder to save for a down payment.

Realtor.com notes that apartment rental prices may stabilize in 2025 due to increased multi-family construction, but urban markets like Austin or Denver still face tight rental supply, keeping costs elevated.

Homeownership, by contrast, locks in housing costs (especially with a fixed-rate mortgage), shielding buyers from rent hikes and allowing them to build wealth through equity rather than funding a landlord’s investment.

Vegepod — Raised Garden Bed — Self Watering Container Garden Kit with Protective Cover, Easily Elevated to Waist Height, 10 Years Warranty (Large)

2025 Market Outlook: Interest Rates

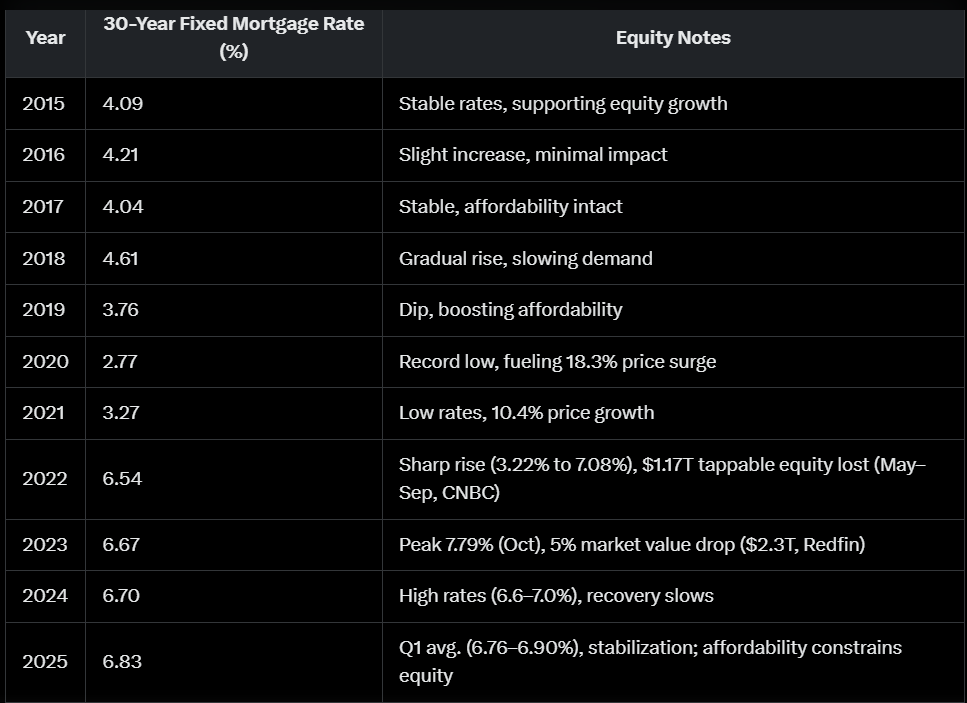

Interest rates are a critical factor in 2025’s housing market, with Freddie Mac projecting 30-year fixed mortgage rates to stabilize between 6.5% and 7% throughout the year.

This aligns with NAR’s chief economist Lawrence Yun, who expects rates around 6% in 2025, citing large federal budget deficits that limit significant declines. Unlike 2024, when buyers anticipated sharper rate cuts.

https://medium.com/@TheRealEstateHUB/subscribe

The consensus for 2025 is “higher for longer” rates, as inflation remains above the Federal Reserve’s 2% target.

Buyers waiting for rates to drop to 4% or 5% may be disappointed, as economic resilience and policy uncertainties (e.g., potential tariffs under a new administration) keep rates elevated.

2025 Market Outlook: Inventory

Housing inventory remains a key driver of 2025’s market dynamics, with supply still below historical norms despite gradual improvements.

NAR reported a 3.5-month supply of existing homes in January 2025, up 16.8% from the prior year but well below the 5–6 months considered a balanced market.

Realtor.com forecasts a slight increase to 4.1 months by year-end, driven by new construction and a loosening “rate lock-in effect,” where homeowners with low-rate mortgages (e.g., 3.5%) are reluctant to sell.

Freddie Mac notes that the lock-in effect, valued at $47,800 per borrower in November 2024, is easing as rates decline slightly, potentially adding inventory in markets like Florida and Texas.

New construction, with single-family starts up 7.4% in March 2025, offers opportunities in regions like the Southeast.

Act on Readiness, Not Market Timing

The 2025 housing market, characterized by stable but high mortgage rates (6.5–7%), tight but improving inventory.

Moderated price growth (1.3–3.7%), rewards buyers who act based on personal financial readiness rather than attempting to time the market.

Historical data and current trends show that waiting for lower rates or prices often leads to missed equity, higher rents, and fiercer competition when conditions shift.

By securing financing (e.g., FHA loans with 3.5% down), targeting markets with new construction, and working with experienced agents, buyers can navigate 2025’s challenges and build wealth through homeownership.

Delaying in hopes of a perfect market risks financial opportunities that may not return for years.

By prioritizing your readiness over market timing, you’ll seize 2025’s opportunities without getting stuck on the sidelines.

Boosting Home Value with Cosmetic Repairs and Upgrades

In 2025, Michigan’s real estate market offers unique opportunities for investors and first-time homebuyers using FHA loans to purchase and enhance properties.

With buyers seeking move-in-ready homes and renters favoring modern aesthetics, strategic cosmetic repairs and upgrades deliver high returns on investment (ROI), making them ideal for those leveraging FHA 203(k) loans to buy and renovate.

These improvements enhance a property’s appeal, functionality, and marketability, positioning it for appreciation in Michigan’s diverse markets, from urban Detroit to suburban Grand Rapids.

According to the 2024 Remodeling Magazine’s Cost vs. Value Report, well-executed cosmetic upgrades can recoup 50–150% of their costs, amplifying value for Michigan investors and new homeowners.

Amazon Echo with Alexa (newest model), Smart speaker with premium sound, Ideal for large bedrooms, living rooms and kitchens, Charcoal

High-ROI Cosmetic Upgrades: Fresh Paint

A fresh coat of paint, costing $1,000–$5,000 with an ROI of 100–150%, is a top upgrade for Michigan properties.

Neutral tones like grays or whites create a spacious, welcoming feel that resonates with buyers and renters in markets like Ann Arbor or Lansing.

Exterior painting boosts curb appeal, critical in Michigan’s competitive suburban markets, where Zillow’s 2025 data shows homes with updated exteriors sell 12% faster in areas like Macomb County.

For the FHA 203(k) borrowers, including paint in a Limited 203(k) loan (up to $35,000) is a low-cost way to transform fixer-uppers, especially in Detroit’s revitalizing neighborhoods, where affordable homes are abundant.

High-ROI Cosmetic Upgrades: Kitchen and Bathroom Refresh

Kitchens and bathrooms drive a property’s value in Michigan, where renters and buyers prioritize modern functionality.

A kitchen refresh, costing $5,000–$15,000 with an 80–100% ROI, includes updating countertops (e.g., quartz), cabinet hardware, and backsplashes, per the 2024 Cost vs. Value Report.

Energy-efficient appliances appeal to eco-conscious tenants in college towns like East Lansing, home to Michigan State University. Bathroom updates, ranging from $3,000–$10,000 with a 70–90% ROI, involve replacing vanities, upgrading lighting, and regrouting tiles.

Adding walk-in showers can command higher rents in Grand Rapids, where Michigan Home Sales data notes 4% rent growth in 2025. These upgrades fit perfectly within an FHA 203(k) loan’s scope, enhancing rental potential and equity.

High-ROI Cosmetic Upgrades: Flooring and Landscaping

Flooring upgrades, costing $2,000–$10,000 with a 70–100% ROI, are essential for Michigan’s varied buyer base.

Replacing worn carpets with hardwood or luxury vinyl plank (LVP) appeals to families in suburban areas like Oakland County, where Redfin reports homes with modern flooring fetch 5–6% premiums.

Landscaping, budgeted at $1,000–$5,000 with a 50–100% ROI, enhances curb appeal in Michigan’s four-season climate. Trimming shrubs, adding mulch, and planting perennials, paired with a new front door, can lift perceived value by 3–5%, per the Michigan Realtors Association.

For FHA buyers, these upgrades, funded through a 203(k) loan, make properties stand out in markets like Kalamazoo, where new construction is rising.

Tips for Maximizing VALUE in Michigan

Michigan investors and FHA homebuyers should tailor upgrades to local preferences to maximize ROI.

In tech-driven Ann Arbor, smart home features like Wi-Fi thermostats are popular, while suburban markets like Holland value outdoor spaces like patios, per local X posts.

DIY tasks like painting save labor costs, but hire professionals for electrical or plumbing to meet FHA’s Minimum Property Standards.

Energy-efficient upgrades — LED lighting, low-flow fixtures, or insulated windows — reduce utility costs in Michigan’s cold winters and may qualify for 2025 Energy Efficient Home Improvement Tax Credits, per the IRS.

Staging, which the National Association of Realtors says boosts offers by 1–5%, is crucial for FHA buyers planning to sell or rent post-renovation.

Multi-Family Application for Michigan Investors

For Michigan investors using FHA loans to buy multi-family properties (2–4 units), cosmetic upgrades across units can increase rents and minimize vacancies, aligning with the state’s strong rental demand.

A $10,000 renovation per unit — covering paint, flooring, and kitchen updates — can raise monthly rent by $100–$150, recouping costs in 5–7 years while boosting resale value.

In Detroit, where CoStar projects 3–4% rent growth in 2025 and vacancy rates are below 7%, modernized units attract tenants quickly.

FHA 203(k) loans make this strategy accessible, allowing investors to house-hack by living in one unit and renting others, offsetting mortgage costs in markets like Flint or Saginaw.

Budget Hacks and Michigan Market Considerations

To stretch budgets, Michigan investors can reface kitchen cabinets, saving 50% compared to replacements, or shop at Habitat for Humanity ReStores in cities like Grand Rapids for discounted materials.

Prioritizing kitchens, bathrooms, and entryways maximizes impact, especially in affordable markets like Flint, where Michigan Realtors note median home prices of $150,000 offer high ROI potential.

However, ROI varies by region — upgrades in high-cost Ann Arbor may yield lower percentage returns due to elevated prices, while Lansing’s $200,000 median price point amplifies gains, per Redfin.

https://medium.com/@TheRealEstateHUB/subscribe

By aligning upgrades with local trends, using platforms like Zillow or X for insights, and leveraging FHA 203(k) financing, Michigan’s 2025 homebuyers and investors can enhance property value and thrive in a competitive market.

Your 2025 Homebuying Playbook: A Unified Strategy for Michigan Investors and FHA Homebuyers!

In 2025, Michigan’s housing market offers a wealth of opportunities for investors and first-time homebuyers using FHA loans, provided they combine creative financing, timely action, and value-enhancing strategies.

The FHA 203(k) loan is a cornerstone of this playbook, allowing buyers to purchase fixer-uppers and finance renovations with just 3.5% down, targeting high-demand rental markets like Detroit, Grand Rapids, or Ann Arbor for strong cash flow.

By focusing on properties needing cosmetic or structural upgrades, buyers can transform undervalued homes into profitable rentals or equity-rich assets.

Pairing this with house-hacking — buying a 2–4 unit multi-family property, living in one unit, and renting out the others — maximizes returns by offsetting mortgage costs while meeting FHA’s 12-month occupancy rule, a strategy particularly effective in Michigan’s affordable markets like Lansing or Flint.

Rather than waiting for “perfect” market conditions, Michigan buyers should act decisively in 2025, as timing the market often leads to missed opportunities.

With median home prices in Michigan ranging from $150,000 in Flint to $300,000 in Ann Arbor (per Michigan Realtors), and rent growth projected at 3–4% in urban centers (per CoStar), securing financing now locks in costs and builds wealth through appreciation (forecasted at 2–3.7% by NAR and Realtor.com).

Cosmetic upgrades, such as fresh paint, kitchen refreshes, or flooring updates, can be funded through a 203(k) loan or budgeted post-purchase, boosting equity and rental income.

For example, a $10,000 kitchen remodel in a Grand Rapids duplex could increase rent by $150 per unit, recouping costs in five years while enhancing resale value.

To execute this playbook effectively, partnering with experts is critical. Work with real estate agents, lenders, and contractors experienced in FHA 203(k) loans and multi-family properties to navigate Michigan’s diverse markets, from revitalizing Detroit neighborhoods to suburban Kalamazoo.

Crunching the numbers using tools like BiggerPockets ensures positive cash flow and ROI, especially for multi-family investments where rental income must cover mortgage, taxes, and maintenance.

Anker SOLIX F3800 Plus Portable Power Station with 400W Solar Panel, 3,840Wh, 6,000W AC Output, 120V/240V, Generators for Home Use, Works with Generator

Staying informed through platforms like X or industry sites like HousingWire allows buyers to adapt to 2025’s shifts, such as rising inventory from new construction in West Michigan or stabilizing interest rates (6.5–7%, per Freddie Mac).

These steps mitigate risks like vacancy or renovation overruns, ensuring a sound investment.

By integrating these strategies — leveraging FHA 203(k) financing, house-hacking multi-family properties, acting promptly, and adding value through upgrades — Michigan investors and FHA homebuyers can turn 2025’s housing market into a springboard for financial freedom.

Whether you’re a first-time buyer in Saginaw or an investor scaling a portfolio in Ann Arbor, this playbook transforms real estate into both a home and a wealth-building asset.

With Michigan’s affordability, strong rental demand, and FHA loan accessibility, 2025 is the year to act decisively, building equity and securing a brighter financial future in one smart move.

Critical Risks For You to Consider!

Risks to Consider for Michigan Investors and FHA Homebuyers in 2025

While the FHA 203(k) and multi-family investment strategies offer compelling opportunities for Michigan investors and first-time homebuyers in 2025, several risks warrant careful consideration to ensure success.

Renovation challenges are a primary concern, as the FHA 203(k) loan’s six-month renovation timeline can be disrupted by contractor delays, supply chain issues, or unexpected structural problems, particularly in Michigan’s older housing stock, such as Detroit’s pre-war homes.

Cost overruns, often 10–20% above initial estimates, can strain budgets, especially for Standard 203(k) projects requiring major repairs like roofing or foundation work.

To mitigate this, buyers should hire licensed, 203(k)-experienced contractors, secure multiple bids, and include a contingency reserve in their budget.

Partnering with a HUD-approved consultant for Standard 203(k) loans ensures compliance and quality, reducing the risk of costly rework.

Landlord responsibilities and vacancy risks pose additional challenges, particularly for multi-family investors employing house-hacking.

Managing tenants in markets like Grand Rapids or East Lansing involves time-intensive tasks such as maintenance, lease enforcement, and resolving disputes, compounded by Michigan’s landlord-tenant laws, which require strict adherence to regulations on security deposits and evictions.

Vacancies, estimated at 5–7% annually in Michigan’s urban centers (per CoStar), can disrupt cash flow, especially if units remain unrented during turnover.

Investors should budget for vacancy reserves, select properties in high-demand areas with low vacancy rates (e.g., Ann Arbor’s 5% rate), and consider hiring a property manager (8–10% of rental income) to streamline operations, though this reduces profits.

FHA loan limits and market-specific risks can also complicate strategies. In Michigan, FHA loan caps — $498,257 for single-family homes and up to $957,600 for four-unit properties in high-cost areas like Ann Arbor — may restrict options in pricier markets, requiring larger down payments or alternative financing.

Economic uncertainties, such as Michigan’s reliance on manufacturing and potential job market fluctuations, could soften rental demand in industrial hubs like Flint, impacting cash flow.

Buyers should conduct thorough market research using tools like Zillow or Rentometer, verify rental income projections, and consult local experts to align investments with stable, growing markets like Grand Rapids, where 3–4% rent growth is projected for 2025.

By anticipating these risks and planning strategically, Michigan’s 2025 homebuyers can leverage FHA strategies to build wealth while minimizing pitfalls.

Comments

Post a Comment